Social Security Max 2024 Tax Withholding. You can ask us to withhold federal taxes from your social security benefit payment when you first apply. You file a federal tax return as an individual and your combined income is between $25,000 and $34,000.

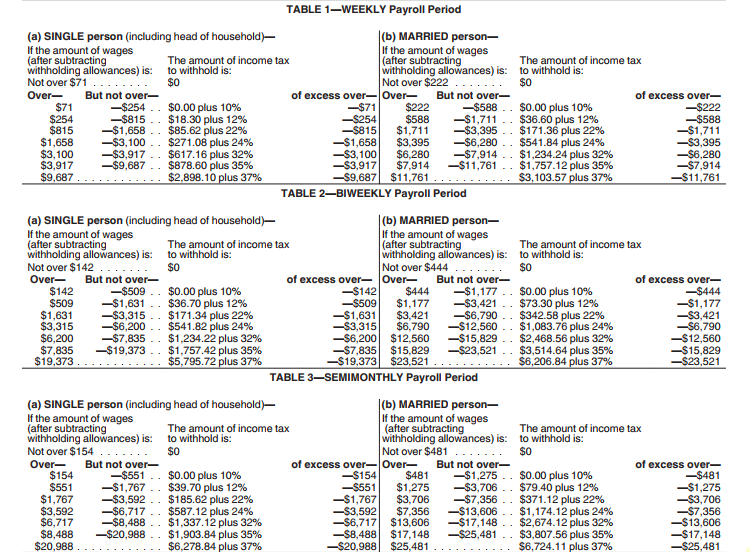

Calculate the estimated payroll taxes due on wages for both employees and employers. For 2024, the social security tax limit is $168,600.

Social Security Max 2024 Tax Withholding Images References :

Source: pauleydominique.pages.dev

Source: pauleydominique.pages.dev

Social Security Max Withholding 2024 Increase Florry Christalle, An individual who earns under $168,600 in 2024 pays a 6.2% social security tax rate on their entire income.

Source: andibroxanne.pages.dev

Source: andibroxanne.pages.dev

2024 Social Security Withholding Rates Nydia Arabella, The wage base or earnings limit for the 6.2% social security tax rises every year.

Source: magdaqangelique.pages.dev

Source: magdaqangelique.pages.dev

Max Social Security Tax 2024 Withholding Amount Tonia Blondie, The maximum employee share of the social security tax contribution will increase from $9,932.40 to $10,453.20 in 2024.

Source: mornaqnorrie.pages.dev

Source: mornaqnorrie.pages.dev

Social Security Withholding 2024 Binny Cheslie, Calculate the estimated payroll taxes due on wages for both employees and employers.

Source: ebbaylouisa.pages.dev

Source: ebbaylouisa.pages.dev

Social Security Withholding 2024 Maximum Age Katha Maurene, For earnings in 2024, this base is $168,600.

Source: debbiebleonelle.pages.dev

Source: debbiebleonelle.pages.dev

Maximum Social Security Withholding 2024 Bonny Christy, That means that the maximum amount of social security tax an employee will pay (through.

Source: dyanneylorraine.pages.dev

Source: dyanneylorraine.pages.dev

Social Security Max 2024 Withholding Tax Winny Kariotta, You file a federal tax return as an individual and your combined income is between $25,000 and $34,000.

Source: dyanneylorraine.pages.dev

Source: dyanneylorraine.pages.dev

Social Security Max 2024 Withholding Tax Winny Kariotta, The social security tax rate.

Source: addaycaresse.pages.dev

Source: addaycaresse.pages.dev

Maximum Social Security Tax Withholding 2024 Elle Wandis, The social security tax rate.

Source: addaycaresse.pages.dev

Source: addaycaresse.pages.dev

Maximum Social Security Tax Withholding 2024 Elle Wandis, Employees and employers split the total cost.

Posted in 2024